Who Can Make a CTP Claim? Withstand Lawyers Explain

Navigating the complexities of Compulsory Third Party (CTP) insurance can be challenging. At Withstand Lawyers, our team of specialized CTP lawyers is here to help you understand your rights and ensure you receive the compensation you deserve. Whether you’re involved in a motor vehicle accident or need clarity on CTP insurance, we’re here to support you every step of the way:

- No Upfront Costs

- No Win No Fee

- 99% Success Rate

- Maximum Lump Sum Payout

If you’ve been injured in a motor vehicle accident, you may be entitled to personal injury compensation.

If your injuries are assessed as ‘non-minor,’ a lump sum payout can help mitigate the financial impacts of your ongoing injuries.

The CTP compensation benefits you may receive include:

What is CTP?

Compulsory Third Party (CTP) insurance is a mandatory insurance that covers individuals injured in a motor vehicle accident. It ensures that if you’re injured in an accident caused by another driver, you are entitled to compensation for your injuries. CTP covers medical expenses, rehabilitation costs, and, in some cases, loss of earnings.

Who Needs CTP Insurance?

Every registered vehicle owner in Australia is required to have CTP insurance. This insurance is crucial as it protects you and others in case of an accident, ensuring that victims are compensated without the need for lengthy legal battles.

Who Can Make a CTP Claim?

Anyone who has sustained an injury as a result of a motor vehicle accident may be eligible to make a CTP claim. This includes:

- Drivers: If you were driving and were injured in an accident caused by another vehicle.

- Passengers: Passengers injured in any vehicle involved in the accident, regardless of which driver was at fault.

- Pedestrians and Cyclists: If you were a pedestrian or cyclist injured by a motor vehicle.

What CTP Benefits Can I Claim?

No matter the severity of your injuries or your role in the accident, you are entitled to claim income support payments and necessary medical expenses for up to six (6) months from the date of the accident. This includes compensation for lost wages due to time off work, reasonable medical treatment costs, and domestic care expenses.

If you were not primarily at fault or only partially at fault, and your injuries are non-minor, you may be eligible to claim beyond the initial six (6) months. Additionally, you could be entitled to a lump sum payout covering past and future loss of income, as well as compensation for pain and suffering.

What is Required For a CTP Claim?

Your eligibility for a CTP compensation payout depends on two key factors:

- Fault: You must not be mostly or wholly at fault for the accident.

- Injury Severity: Your injuries, whether physical or psychological, must be assessed as non-minor.

To determine if your injuries are classified as non-minor, you can contact our lawyers for a free eligibility check. Alternatively, within three months of submitting your Personal Injury Claim Form, the CTP insurer is required to assess your injuries. They will decide whether your injuries are minor or non-minor, which will determine if your statutory benefits continue beyond six months and whether you’re eligible for a payout.

If the insurer classifies your injuries as minor, you have the right to request a review within 28 days of their decision. We’ve successfully assisted hundreds of clients in overturning insurer decisions. Let us handle the process, removing the stress and uncertainty from this critical decision that impacts your future.

If you were not at fault and your injuries are assessed as non-minor, you will be eligible to receive a CTP compensation payout.

How Do I Make a CTP Claim?

- Obtain a completed Certificate of Fitness Capacity from your treating doctor or from the State Insurance Regulatory (SIRA) website.

- Complete and submit an Application for Personal Injury Benefits form to the CTP insurer of the at fault vehicle. The form outlines the necessary requirements for acceptance. To identify the CTP insurer, you can contact SIRA or use the Service NSW app by entering the at-fault vehicle’s registration.

You must lodge your Application and certificate within three months after the date of the accident, or within 28 days if you want to claim back payment for lost earnings, from the date of the accident.

How Long Does a CTP Claim Take?

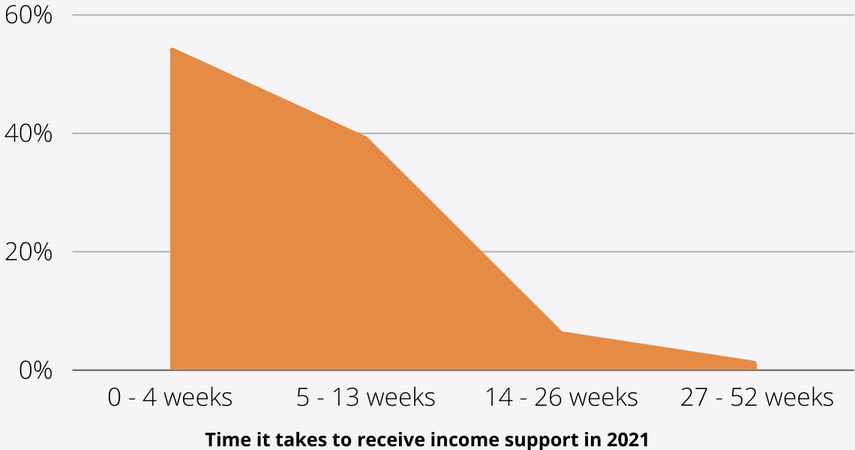

The duration of a CTP claim depends on the nature of your injuries and how long it takes for them to medically stabilize. Here’s an overview of the typical timeline for receiving income support payments:

- Within 4 Weeks: Most claimants start receiving income support payments within the first four weeks of their claim.

- Within 13 Weeks: If payments don’t begin within the first month, it’s likely they will start within 13 weeks.

- After 14 Weeks: Only about 7% of claimants receive income support payments after 14 weeks.

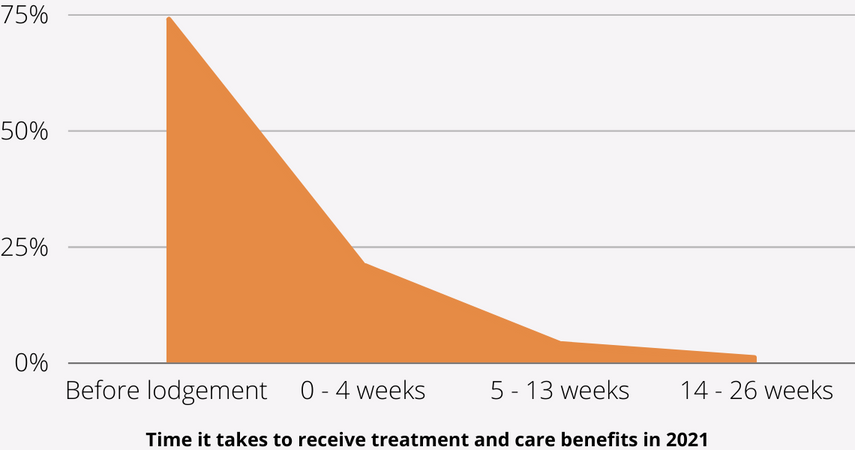

Regarding medical treatment and care benefits, you may start receiving coverage even before lodging a formal claim. In 2021, 74% of claimants began receiving pre-claim support within the first month, while only 5% received it after the first month.

Beyond income support and medical expenses, the final payout of your CTP claim can take between 1 to 3 years to be resolved.

It’s important to remember that each motor vehicle accident affects individuals differently, and settling a compensation claim too quickly may not be in your best interest. For instance, if you require surgery, our experienced CTP lawyers may advise against settling your motor vehicle accident claim early to ensure the long-term impact on your work capacity is fully considered while you continue to receive income support and treatment benefits.

Learn about the best time to settle your personal injury claim here.

Is There a Time Limit to Make a CTP Claim?

To lodge a CTP claim, you need to submit an Application for Personal Injury Benefits form to the insurer, along with supporting evidence and a medical certificate. If you want to claim back pay for lost earnings, you should file your claim within 28 days of the accident. Otherwise, you have up to three months from the accident date to lodge the claim.

A claim for common law damages (payout) can typically be made 20 months after the accident. However, if your injuries are assessed as having more than a 10% permanent impairment, you can submit the Application for Common Law Damages immediately after that determination, without waiting for the 20-month period. If your injuries are assessed as less than 10% permanent impairment, you must wait the full 20 months. Our CTP lawyers diligently prepare your payout claim so that it can be resolved shortly after the 20-month mark.

It’s crucial to apply to the Personal Injury Commission for a determination of your payout claim within three (3) years from the date of the accident. If you miss this deadline, you will need to provide an explanation for the delay. While you can apply before the 3-year limit, this is the maximum time allowed. If you were unaware of the 3-year time limit or missed it, our lawyers can assist you in providing an explanation to the Personal Injury Commission. We take pride in helping clients navigate these situations, particularly those who were self-represented and unaware of the deadlines.

FAQ

Our CTP lawyers are here to guide you through every step of your CTP claim. We offer expert advice, gather necessary evidence, and manage all communications with insurers and other parties on your behalf. Without specialized knowledge in CTP claims, you might miss key entitlements, deadlines, or potential compensation. Each CTP claim is unique, with different outcomes and payouts. Our clear, straightforward legal advice ensures you have confidence and clarity from the beginning of the process.

You can consult our CTP compensation lawyers at any stage of your motor accident injury claim. However, we recommend reaching out as soon as you recognize that the accident has caused you injuries. This is crucial due to strict time limits. We offer a Free Claims Assessment, so there is no cost to you for getting expert advice early in the process.

If you do not receive a lump sum payout, our CTP lawyers will not charge you any fees. If you do receive a lump sum payout, our legal costs will be deducted from your settlement amount. We recommend contacting our CTP lawyers for a Free Claims Assessment, available by phone or in person. During this assessment, we will provide you with an estimate of our costs, giving you peace of mind about what to expect.

Our offices are conveniently located in Northern Beaches, Sydney CBD, Bexley, Wollongong, Newcastle, Campbelltown, Liverpool, Penrith, Parramatta and Blacktown. Our senior motor accident injury lawyers also offer home visits for our injured clients.

Motor vehicle accidents can cause one or multiple injuries at the same time. Some of the most common injuries are as follows:

Our Values and No Win No Fee Policy

Our senior CTP lawyers specialise in personal injury claims which include CTP claims.

We strive to provide you with the highest degree of advice in the clearest possible terms to ensure you understand the law, your entitlements and the process. You will feel confident knowing that your CTP claim is being looked after by our friendly and professional CTP lawyers.

Our CTP lawyers also work under our No Win No Fee policy which means you only pay for our legal costs if you win. Reach us today for a free claim check!

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Work Cover Independent Review Office

• Member of the Law Society

Rear Ended in a Car Accident? What to Do and How to Claim Compensation

Being rear ended by a car, especially while stopped at a red light or in traffi, can be a sudden and stressful experience. One moment

Dog Attack Compensation NSW – Claim Payouts & Legal Advice

A dog attack can be a terrifying and life-changing experience. Whether you suffered severe physical injuries or are dealing with the emotional trauma that follows,

What Percentage Do No Win No Fee Lawyers Take in Australia?

If you’re searching for a lawyer, you’re likely dealing with a stressful situation—whether it’s a workplace injury, a car accident, or another personal injury claim.

Do You Accrue Annual Leave While on Workers’ Compensation in NSW?

If you’re on workers’ compensation in NSW, you might be wondering: Do you accrue annual leave while on workers’ compensation? Or even, Can I take

Can You Sue for Emotional Distress in Australia?

Emotional distress is invisible, yet its impact can be overwhelming. If you’ve been struggling with anxiety disorders, depression, or PTSD due to someone else’s actions,

What Qualifies as a Total and Permanent Disability?

Life can change in an instant. One day, you’re working, earning an income, and planning for the future—then suddenly, an injury or illness takes that