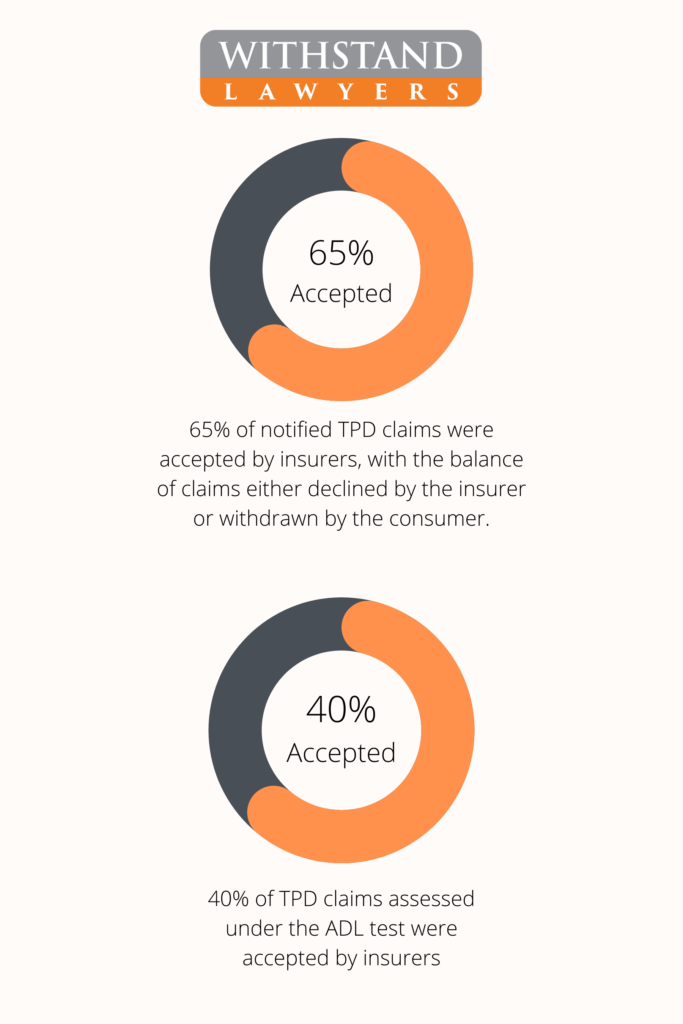

Before looking at what consumers are getting out of their TPD insurance and the effectiveness of their policies, it is important to define Total and Permanent Disability (TPD) Insurance. TPD insurance is a specific type of insurance where a specific lump sum amount is paid to the insured (employee) if they become totally and permanently disabled under the terms of the insurance policy. ASIC Report 633 reviewed TPD insurance claims, and found that although 26,000 TPD claims were made through superannuation funds, only 65% of TPD claims were accepted by insurers.

Significant findings in the realm of TPD insurance were made in this report, and this may be demonstrated by way of the fact that around three out of five (or 60%) of claims assessed under this narrow cover are declined- which is also five times higher than the average declined claim rate for all other TPD claims (12%). Further to this, where Insurers committed to inconsistent lodgement processes such as poor communication practices when it was time for TPD claims to be made, it more often prevented the claim from succeeding- and this is where our experienced TPD lawyers at Withstand Lawyers can assist you in obtaining the best result.

In addition, ASIC Report 675 draws attention to certain areas that Superannuation Trustees need to rapidly improve upon if Australians are to receive benefits from their TPD insurance policies. For example, the December 2020 report drew attention to two major concerns- the first being that: there is unfortunately wide variation in default cover offered- with some large MySuper products offered over 20 times as much default cover as the smaller ones. Also, the second and most resounding issue found by the Report was that certain trustees were unable to properly identify which members had default insurance. For this reason, if Superannuation Trustees in Australia are to fulfil their promise of offering good TPD insurance policies to their customers, then it is essential for them to abide by the Australian Prudential Regulation Authority’s Prudential Standard SPS 515 Strategic planning. It provides Trustees with a handy guide as to how to assess outcomes provided to members in insurance areas, and helps them to identify opportunities for improving these outcomes. Due to these difficulties faced with TPD insurance and in ensuring that the best outcome is achieved, our TPD lawyers at Withstand Lawyers are readily available to assist to resolve any queries or concerns you may have.

How can Withstand Lawyers help you?

At Withstand Lawyers we are committed to assisting you after what may be regarded as a tumultuous period in your life, after having sustained a life-changing injury or illness. Our No win No fee lawyer work on a No Win No Fee basis, which means that unless you receive a successful outcome by way of payment, you will not pay our costs and disbursements. Contact us if you have any concerns with your TPD policy, and our legal team will readily act on your behalf to ensure you receive the best possible TPD payout possible for your TPD claim.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society