How Long Does a TPD Claim Take?

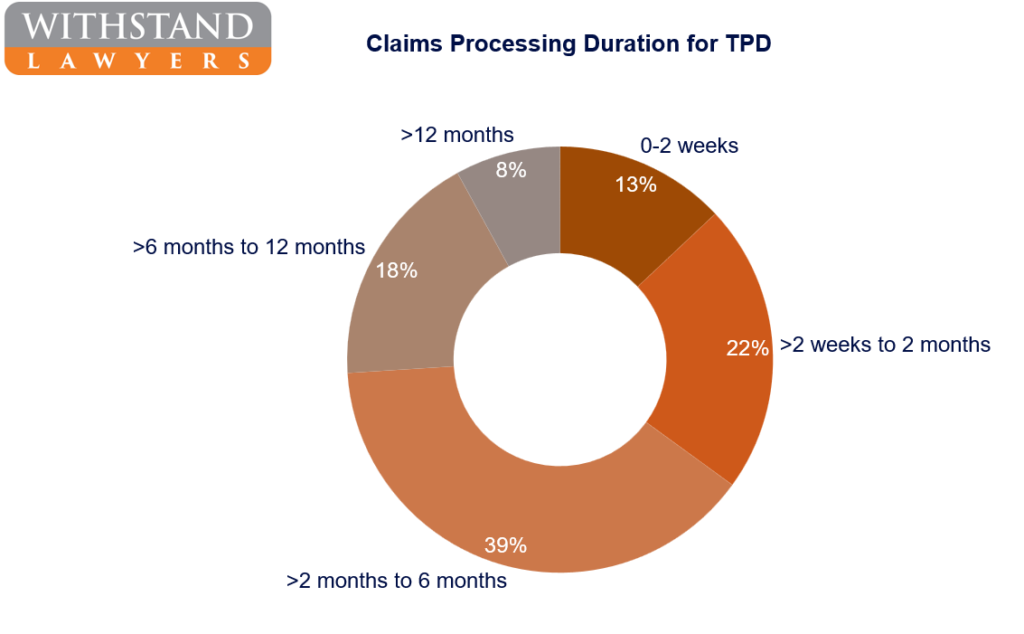

In Australia, the average TPD claim will take 5.3 months to resolve (ARPA, 2022). However the range of the duration of successful TPD claims can vary from as little as a few weeks, to even more than 12 months in some cases.

If you’re hoping to shorten your TPD claim processing time, this article is for you. Over the years, I’ve seen how a few strategic steps can make a huge difference in how quickly a claim moves along. Here’s what we’ll dive into:

- Top 3 Tips to Speed Up Your TPD Claim: Tried-and-true strategies to help you cut down those long wait times.

- Common Factors That Delay Claims: Knowing the common obstacles can give you a head start in avoiding them.

- How Withstand Lawyers Can Streamline Your Claim: We’ll show you how our approach can keep your claim on track and boost your chances of a quick, successful outcome.

With these insights, you’ll have the tools to make a real impact on your TPD claim timeline.

Top 3 Tips to Speed Up Your TPD Claim

1. Confirmation of Receipt?

Request receipt or confirmation from the superfund that they received your TPD claim documents, forms and evidence! Why? Because sometimes they may not receive it for whatever reason and that alone can delay the process by months.

I have personally experienced instances where, despite requesting receipt confirmation of our clients’ TPD claim lodgement multiple times, they have only confirmed receiving our second follow-up, which we send within days due to this recurring issue.

2. Will your injury prevent you from working?

Make sure you make it easy for the decision maker in terms of setting out how your TPD claim meets the relevant TPD definition within your policy. As a TPD lawyer I would recommend you submit alongside your documents, a letter or email explaining how you meet the TPD definition on every level.

That not only helps you make sure you actually meet the relevant definition of how your circumstances and evidence meet the relevant eligibility but also makes it easier for the decision maker who will be deciding whether to approve or refuse your TPD claim.

For example, we had a client who had lodged his TPD claim on his own and it was mainly fine except for the important fact that he forgot to explain his past work experiences with evidence such as tax returns or CV.

He had lodged the claim 7 months before us, and it hadn’t been decided on yet. Upon providing the CV, evidence of his past work experiences in labour only provided the superfund with better context it needed to make a decision quicker.

Sometimes, the superfund may think the injury or condition on its own cannot prevent you from working but some definitions are that you are unable to work within your education, training, or experience. That’s why making clear your experience with evidence is important.

Read our dedicated blog about the different TPD definitions.

3. Pre-existing clauses?

Look out for clauses that may prevent you from being eligible to claim. For example, if you have multiple health conditions and one on its own prevents you from working which is not a pre-existing condition, ask your doctors their opinion on that alone without complicating your TPD claim.

What Will Delay a TPD Claim?

Both the insurer and trustee will carefully examine the evidence you provide about your disability and its impact on your ability to work. This includes medical reports, financial records, and any other documents that support your claim. Without enough accurate documentation, you may face a frustrating and time-consuming back-and-forth with your superfund, which can add unnecessary stress.

Providing complete and relevant documents from the start is essential for having your TPD claim processed as quickly as possible. Our TPD lawyers have guided thousands of clients through this process and work regularly with superfunds and insurers. We understand their expectations and know how to present your claim effectively to avoid delays.

Can I Make Multiple TPD Claims if I Have More Than One Policy?

If you were a member of more than one superannuation fund at the time of your illness or injury, you may be eligible to lodge TPD claims with each fund, provided you held coverage through each policy. Many people don’t realize that having multiple super funds can open up this possibility, but the key is that each policy must include TPD benefits explicitly. Checking the details of each fund’s coverage is essential to confirm that TPD benefits apply.

Handling multiple claims can feel overwhelming, but it’s a path worth considering for those eligible. At Withstand Lawyers, we’re here to make it simpler. Our team of experienced TPD lawyers can guide you through each claim step-by-step, helping to ensure the best possible outcome for you without the stress of navigating the process alone.

Is There a Time Limit for Lodging a TPD Claim?

In most cases, there isn’t a strict legal time limit for lodging a TPD claim, but timing is still crucial. Each superfund or insurer has its own set of guidelines, and some may have specific time limits or conditions you’ll need to meet to ensure your claim is valid.

Generally, it’s best to start your TPD claim as soon as possible after your injury or illness diagnosis, or when it becomes clear that you’re unable to return to work.

If you are unsure of your TPD Insurance policy, or if you have questions regarding your eligibility to make a claim, it is best to contact an experienced TPD lawyer.

How Withstand Lawyers Can Help Fast-Track Your TPD Claim

At Withstand Lawyers, we understand the importance of a timely TPD payout. Here’s how we work to speed up your claim:

Free Claim Assessment: We start with a free claim check to assess eligibility, ensuring you know your chances and expected timeline from the outset.

Efficient Document Preparation: Our team collects and reviews all necessary documents, coordinating with medical providers and insurers to avoid delays.

Direct Communication with Superfunds: We handle all communications with superfunds and insurers, reducing back-and-forth and keeping your claim on track.

No Win No Fee, with Capped Costs: Our No Win No Fee approach and capped fees mean no financial surprises, letting you focus on your claim.

Transparent Updates: We provide regular updates, keeping you informed on progress every step of the way.

Contact Withstand Lawyers today to fast-track your TPD claim with confidence.

Frequently Asked Questions

Your TPD claim could be denied for various reasons, including:

- Not meeting the specific disability criteria outlined in your policy

- Having an inactive or invalid policy

- Lacking strong medical evidence to support your TPD claim

- Not meeting the required work history criteria

- Failing to disclose any pre-existing injuries

- Errors or inconsistencies in your supporting documents

It’s important to remember that these reasons depend on your insurer’s policy, your unique circumstances, and the medical evidence you provide. Sometimes, even when you feel you’ve submitted all the evidence possible, it may still not be enough for an insurer to approve the claim, which can be incredibly frustrating.

If your claim has been denied, our TPD compensation lawyers are here to help you navigate the process and explore options for moving forward. Reach out to us for support.

Yes.

It’s important to understand that receiving a TPD payout is based on the evidence that demonstrates you are unlikely to ever return to work. However, this doesn’t mean that if you eventually recover from your injury—whether physical or psychological—you are barred from returning to work because of the TPD payout. The assessment is made based on your condition at the time of the claim.

Most Aussies have TPD insurance included in their superannuation. If you have suffered a serious illness or injury that has left you unable to work, you may be eligible to claim TPD compensation from your superannuation fund, depending on your policy. TPD benefits are not automatically granted however; you must submit an official claim to your insurer detailing your situation and providing the necessary evidence.

To qualify for a TPD payout, you will need to medically prove your condition. Start by obtaining a medical certificate from an approved specialist. Additionally, you should provide information about your occupation, payroll records, and any other relevant documents that explain why your injury prevents you from performing your job. Once you have gathered all these documents, complete the claim form and submit it to your insurer to begin the TPD claim process.

Different types of cancer can significantly impact a person’s life, especially if left untreated until advanced stages.

If cancer has prevented you from working, our TPD claim lawyers can help assess your eligibility for making a claim. The details of your superannuation policy and the medical reports documenting your illness will be key factors in determining your eligibility for a TPD claim.

When making a TPD claim, you will need to provide medical evidence to support your claim.

You should review your policy and inform your doctor and other relevant medical practitioners about the definition of your policy. It is also important that you inform your doctor of any other barriers that might prevent you from working.

Additionally, you should include evidence relating to your education, training and work history. This information can help demonstrate that you are unable to perform any other jobs that your superannuation company might consider suitable based on your previous experience, especially after your injury.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society