Have you ever wondered what exactly Total and Permanent Disability (TPD) means when it comes to your superannuation or insurance policy? The “TPD definition” isn’t just a technical term—it’s the key that could unlock essential financial support when you need it most. But here’s the thing: understanding TPD definitions isn’t always straightforward. They vary from one policy to another, and knowing how they apply to your unique circumstances can feel like navigating a maze.

Imagine finding out that your claim depends on criteria you didn’t even realize existed—like whether you can ever return to any job, not just the one you had. This is where things get complicated, and this is also why so many people feel overwhelmed by the process. At Withstand Lawyers, we’re here to demystify TPD definitions and help you make sense of it all. We believe that understanding the details of your policy isn’t just important; it’s empowering.

Let’s dive deeper into how these definitions shape your claim and what steps you can take to ensure your rights are protected.

If you’re already familiar with the TPD definition in your super policy and are ready to make a claim, click here to learn more about the TPD claims process:

What is Total and Permanent Disability (TPD)?

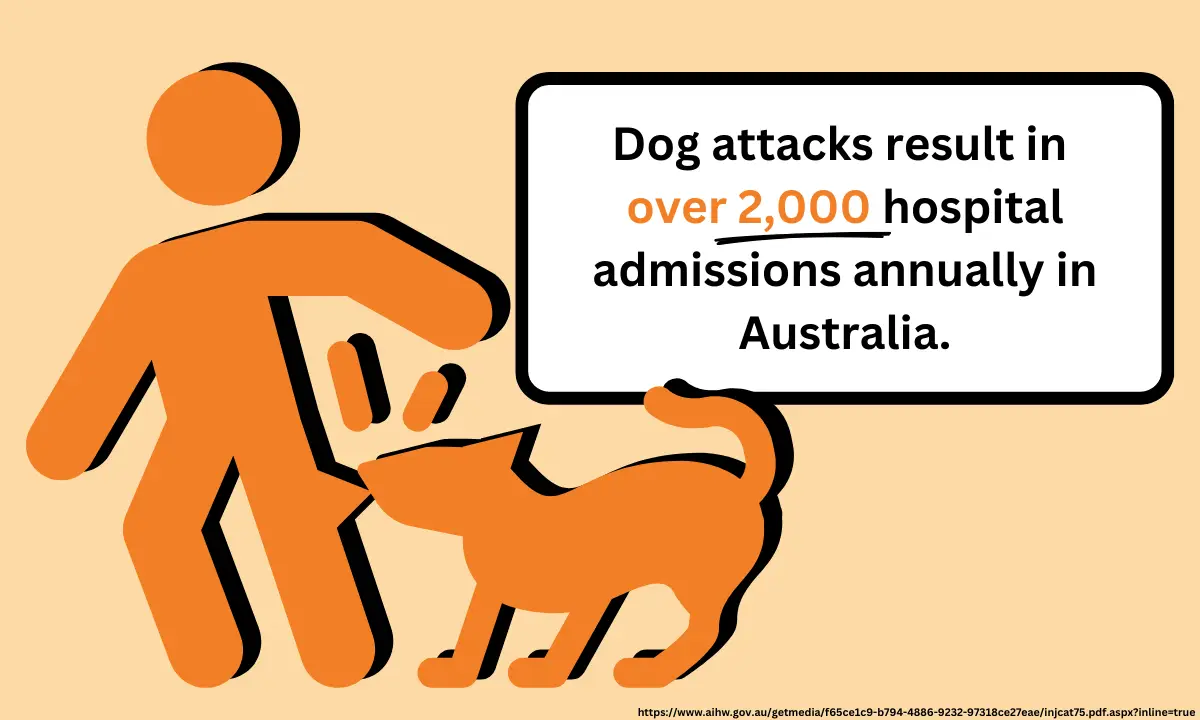

TPD stands for Total and Permanent Disability. It is a type of insurance benefit provided through your superannuation fund or insurance policy. TPD insurance is designed to support you financially if you are unable to work again due to a severe illness or injury. If you qualify for a TPD claim, you may receive a lump sum payment, which can be used to cover medical costs, ongoing living expenses, or any other financial needs resulting from your inability to work.

The eligibility criteria for a TPD claim depend on the specific definitions set out by your insurer or superannuation fund, and these definitions often outline what it means to be totally and permanently disabled for your claim to be approved.

The Types of TPD Definitions

You may be eligible to make a TPD claim if your condition prevents you from working. However, while many TPD definitions share similarities across different funds, each fund has specific requirements you must meet for a successful claim. Some funds even have multiple TPD definitions, with the most challenging criteria often applying if you weren’t working within 12 months from the date you became unable to work.

Your eligibility will depend on how your insurer defines TPD in their policy. For instance, if you stopped working more than 12 months before becoming disabled, you may need to meet the strict activities of daily living TPD definition. This complexity can make navigating TPD claims confusing, but our experienced TPD Lawyers have helped thousands of clients make successful claims.

Typically, there are three main TPD definitions: any occupation, own occupation, and activities of daily living.

Any Occupation TPD Definition

The most common TPD definition is the any occupation definition. To meet this criterion, you generally need to satisfy the following conditions:

- You have stopped working or are unable to work due to an illness or injury.

- You have not worked for a continuous period of at least three or six months.

- After this three- or six-month period, it must be determined that you are unlikely (or unable) to return to any occupation for which you are reasonably suited by your education, training, or experience.

Own Occupation TPD Definition

The next most common TPD definition is the own occupation definition. This may require you to satisfy conditions similar to the “any occupation” criteria, such as:

- Stopping work or being unable to work due to illness or injury.

- Not working for a consecutive period of at least three or six months.

However, with the own occupation definition, the key difference is that you must be unlikely to return to work in your own occupation. The term “own occupation” is often a topic of dispute, but most policies provide guidance on what it specifically means. In some cases, “own occupation” refers to the job you were performing at the time you obtained the policy. In other instances, it may refer to the occupation you were engaged in leading up to when you ceased work. Understanding this definition in your policy is crucial, as it can significantly impact your claim.

Activities of Daily Living TPD Definition

More recently, some superannuation funds are making it more difficult to claim a TPD payout by imposing ‘Activities of Daily Living’ (ADL) test depending on your circumstances at the time of being unable to work.

An ADL test is whether you are unable to do two (2) or more basic tasks such as bathing, dressing, feeding, going to the toilet and transferring yourself in and out of bed. If you are unable to perform 2 or more of the above tasks, and your TPD definition requires that you satisfy the ADL test, then you may be eligible to make a TPD claim.

As you can see, it is a more difficult definition to satisfy than the any occupation or own occupation definitions.

Is a TPD Payout a Lump Sum or Instalments?

The specifics of your TPD definition will play a crucial role in determining not only your eligibility to make a claim but also how your TPD benefit will be paid. Most TPD definitions lead to a lump sum payment, meaning you receive the full amount in one payment. However, some TPD policies specify that the payout will be distributed in instalments over time. If your TPD definition requires instalments, you will likely need to provide regular medical evidence each year to prove your ongoing total and permanent disability and your inability to return to work.

In certain circumstances, you may be able to apply to receive the entire payment as a lump sum, depending on your policy’s TPD definition. Understanding the details of your TPD definition and how it applies to your claim is essential. For a free eligibility check, our TPD Lawyers are here to help. We’ll explain your eligibility, the claim process, and the expected timeframes—all handled on a No Win, No Fee basis.

Other TPD Definitions

While many superannuation funds use common TPD definitions, there are numerous variations, making it impossible to cover every type here. Because of this, it’s essential to treat each case individually. Determining whether you’re eligible to make a TPD claim can be overwhelming, especially if you’re already dealing with physical or psychological symptoms.

If you find yourself in this situation, or if you’re seeking free advice about:

- Your eligibility to make a TPD claim

- Which TPD definition applies to your claim

- How to make a successful TPD claim

- Challenging a refused or denied TPD claim

Call our TPD Lawyers at 1800 952 901. We have extensive experience handling thousands of TPD claims and are well-versed in what various TPD definitions mean. Our team knows exactly what is needed to prepare a successful TPD claim efficiently.

Case Study – Significant Hand Injury for Carpenter Leads to TPD Payout

The Case

Robert, 43, sustained a severe right-hand injury at work, leaving his fingers badly damaged. As a right-handed carpenter with no other qualifications or work experience, his career prospects seemed bleak. Carpentry had been his entire livelihood, and the thought of never returning to his trade left him deeply anxious about his future.

After handling his workers’ compensation claim, Withstand Lawyers referred Robert to their experienced TPD team. Robert was skeptical—he believed that since his injury only affected his hand, a relatively small part of his body, he wouldn’t qualify for a TPD benefit. However, his lawyers thoroughly reviewed his situation.

They examined Robert’s superannuation statement and discovered he held TPD insurance cover. Even more surprisingly, they found an additional superannuation account he’d forgotten about, also containing TPD coverage. Reviewing the TPD definitions and requirements, Robert’s lawyers determined he had reasonable prospects of success, giving him a much-needed sense of relief.

The Outcome

It was confirmed that Robert had been unable to work for eight months due to his hand injury. His TPD lawyers swiftly obtained medical evidence from his doctors that met the policy’s requirements, demonstrating that he was unlikely to return to any occupation suited to his education, training, or experience—carpentry being all he knew.

In the end, Robert’s combined TPD claims resulted in a payout of $683,000. The financial stress lifted, and he was finally able to focus on his recovery. If you’re wondering about your own eligibility, reach out to us for a free claim check. Our TPD Lawyers handle cases on a No Win, No Fee basis, providing the support and guidance you need.

Why Choose Withstand Lawyers For Your TPD Claim?

At Withstand Lawyers, we make the TPD claim process as straightforward and stress-free as possible.

Our experienced TPD Lawyers are committed to giving you the best chance of success, starting with a free eligibility check to assess your case. We handle all the complexities, from reviewing your TPD definitions to preparing strong medical evidence, so you don’t have to.

Plus, with our No Win, No Fee guarantee, you can move forward confidently, knowing you won’t pay any legal fees unless we win your claim.

Contact us to get your claim started today.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society