You know that you are not alone, around 5000 people from Melbourne make TPD claims each year due to being unable to work because of their injury or illness.

Maximising your TPD benefit is crucial for your finance. That’s why, as a TPD lawyer in Melbourne I want to help you understand how our legal services can assist you. In this post, I’ll explain the ins and outs of TPD claims, and how our team can help you navigate the claims process and achieve a positive outcome.

What is a TPD Claim?

TPD stands for “Total and Permanent Disability,” a TPD claim is a type of insurance claim made when you are no longer able to work due to an injury or illness. The injury (either physical or psychological) or illness is not required to be work related or due to someone else’s negligence.

In Melbourne, TPDlaims are typically made through a person’s superannuation fund since around 90% of the TPD policies are provided through superannuation funds. If you become totally and permanently disabled, you can make a claim on your insurance policy to receive a lump sum payment.

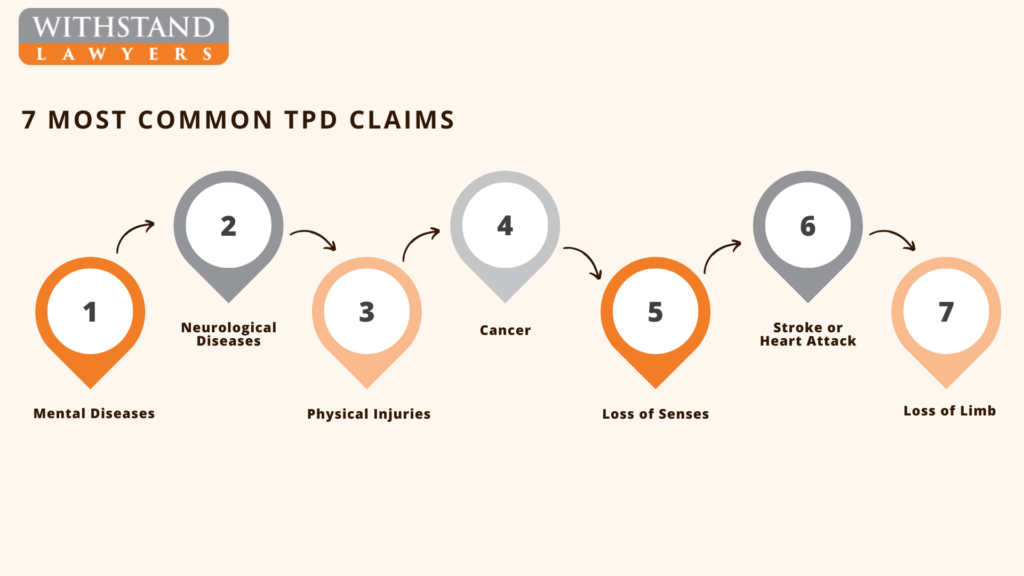

Following injuries or health conditions might make you eligible for a TPD claim:

- Mental illnesses

- Neurological diseases

- Physical injuries

- Cancer

- Stroke

- Heart attack and more.

Are you Eligible for a TPD claim?

To be eligible, you must have an injury or illness that prevents you from working within your usual occupation or any other occupation you are suited for based on your education, training, or experience.

Of course, our TPD lawyer during our free eligibility check will tell you your chances once you provide them with what your injury or illness is along with what education, training and experience you have. It does not necessarily have to be the most serious injury or illness, but rather, what injury or illness you have and how that injury or illness can prevent you from working within what work you are suited in by your education, training or experience.

At Withstand Lawyers, we understand that navigating the eligibility requirements can be confusing and overwhelming. That’s why we offer a free TPD eligibility check. Our experienced TPD lawyers in Melbourne, will review your circumstances and superannuation and insurance policy and advise you on your eligibility for a TPD claim on a No Win No Fee basis. We’ll take the time to explain the criteria and ensure that you have a clear understanding of the process.

Don’t hesitate to get in touch with us today to take advantage of our free TPD eligibility check. Our team is dedicated to helping you understand your legal options and achieve a positive outcome.

How TPD Claims Process Works and How Withstand Lawyers Can Help

The first step in the TPD claims process is determining your eligibility. Once we have established your eligibility, we’ll work with you to gather the necessary evidence to support your claim. This may include:

- Medical reports

- Employment history

- And other relevant documentation.

Our TPD lawyer will then make a claim to your superannuation fund or insurer and negotiate on your behalf to ensure that you receive the maximum benefit possible.

We offer our services on a No Win No Fee basis, meaning that you won’t have to pay any upfront costs. If we are unsuccessful in securing a benefit for you, you won’t owe us anything. This provides peace of mind to our clients and ensures that our team is fully committed to achieving a positive outcome (we have almost 100% success rate for TPD claims).

- No Upfront Costs

- No Win No Fee

- 99% Success Rate

- Maximum Lump Sum Payout

How Much TPD Payout You can Receive in Melbourne?

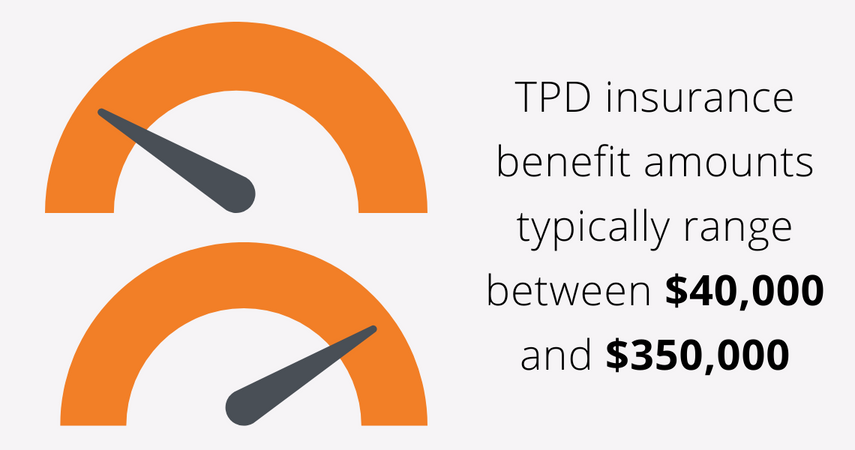

The value of a TPD payout in Melbourne can vary depending on the individual’s circumstances. The payout is typically a lump sum payment made to the individual, and the amount can be around between $40,000 and $350,000. The exact amount of the payout will depend on various factors, such as:

- Your age

- Income

- Level of cover you have in your superannuation fund or TPD policy.

At Withstand Lawyers, our experienced TPD lawyers can help you understand the value of your potential payout and ensure that you receive the maximum benefit possible.

Rejected TPD Claim - What to Do Next

Having a TPD claim rejected can be a frustrating and overwhelming experience, but it’s important to know that you still have options. If your TPD claim has been rejected in Melbourne, the first step is to seek legal advice from an experienced TPD lawyer.

At Withstand Lawyers, our team of experienced TPD lawyers can review your claim and assess the reasons for the rejection. We can identify any weaknesses in your claim and provide you with legal advice on the next steps to take. We can also help you challenge the decision, which can involve requesting a review of the decision, making a complaint to the Australian Financial Complaints Authority (AFCA) or commencing Court Proceedings.

It’s important to act quickly if you have received a rejection letter, as there are strict time limits for challenging the decision. Our lawyers can guide you through the process and provide you with the support you need to secure the financial support you deserve. We’ll work with you to gather the necessary evidence and submit your claim before the deadline, ensuring that you receive the maximum benefit possible.

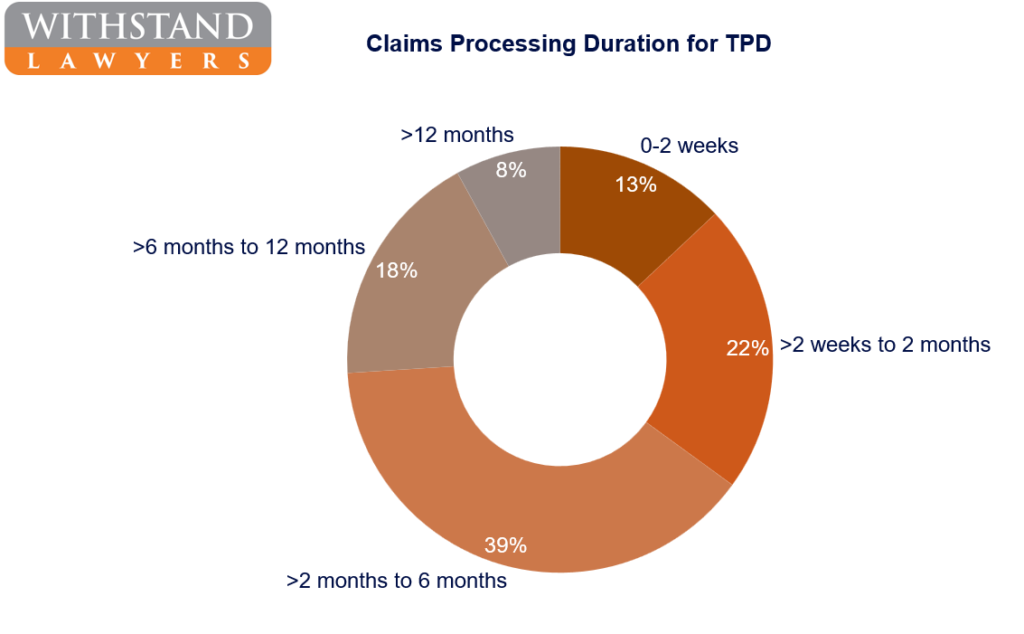

How Long Does a TPD Claim Take in Melbourne?

Statistics suggest that the average duration for a TPD claim is around 5-6 months. However, this period can be extended if, amongst other reasons, the insurer is not satisfied with your evidence.

Why Choose Withstand Lawyers for Your TPD Claim

- Withstand Lawyers has a high success rate in securing TPD claims for clients.

- We offer a No Win No Fee policy, so there are no upfront costs for our services.

- Our client-focused approach has earned us many positive testimonials.

If you’re considering making a TPD claim in Melbourne, contact Withstand Lawyers for a free consultation and let us help you have the best chance of receiving an approval.

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society