TPD Claim Statistics

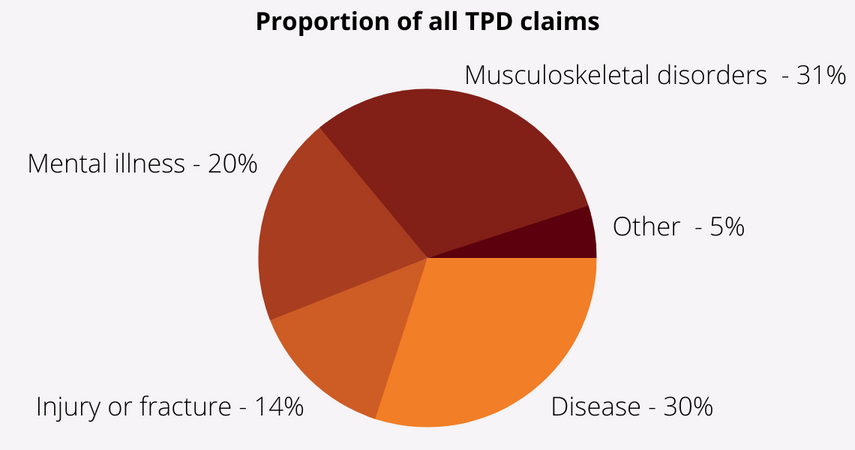

What are the most common TPD claims?

You may be entitled to make a TPD claim if you are injured regardless of the reason for your injury or illness. Some medical conditions are more common than others. The statistics indicate that 31% of the TPD claims in Australia were made due to musculoskeletal disorders, which makes it the most common TPD claim reason. It is followed by diseases that account for 30% of the TPD claims.

The third and fourth most common cause of TPD claims is mental illnesses (20%) and injury/fractures (14%) respectively.

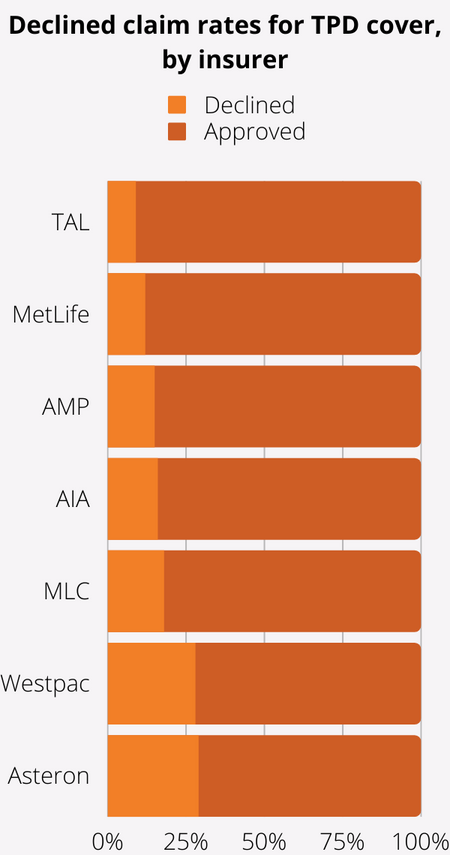

What is the percentage of declined claim rates by superannuation insurers?

Australians have been asking which Superannuation insurance company is the best and worst. Even though it’s hard to give a straight answer, you can see the percentage of refusal and approval rates of the 7 companies above to have an opinion about them.

Amongst the 7 Australian superannuation insurers, Asteron has the highest refusal rate per claim by 29%; meaning that almost every third claim is not paid by Asteron.

The highest approval rate is 91% by TAL, which means that less than 1 out of 10 claims are refused by them. It is important to note that the overall approval/refusal rate does not show whether a superannuation company is good or bad.

There are multiple variables that affect the result of your TPD claim.

We have broken down the statistics of TPD claims for you.

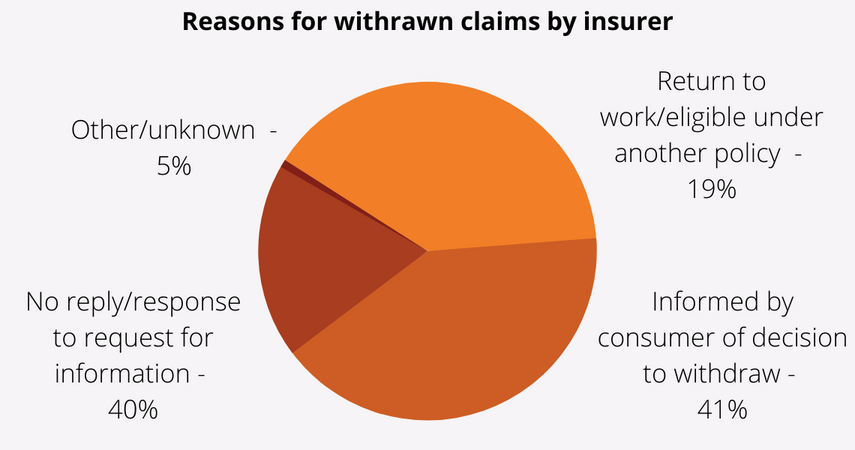

What are the most common reasons for withdrawal?

There are 2 main reasons for TPD claim withdrawals that accounts for 81% of the refusals. 41% of the reasons are the decision of the consumer to withdraw and 40% are the lack of response to a request for information. Only 19% of the claims are refused because of returning to work.

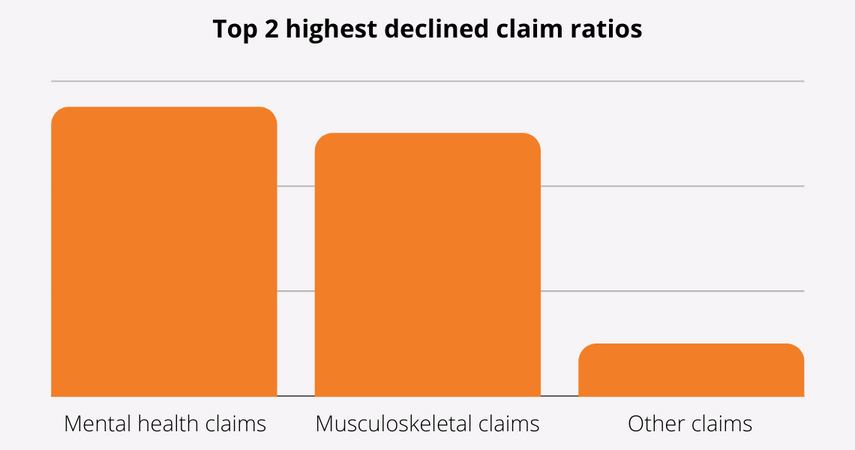

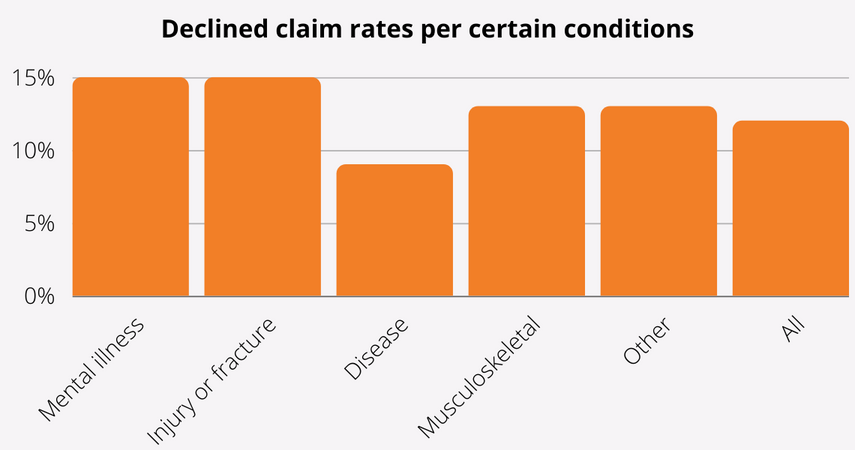

Which medical conditions get refused the most?

Normally, if you are unable to work, you can be entitled to receive TPD benefits. However, if you have mental health or musculoskeletal diseases, it’s approximately five times more likely to get your claim declined by your insurer.

What is the refusal rate of medical conditions?

Compared to other medical conditions, statistics show that diseases have almost a 2 times lower refusal rate. While mental illness–related and fracture claims have the highest decline rate at 16.9% and 16.1, TPD claims for disease-related conditions had a lower decline rate of 9.7%.

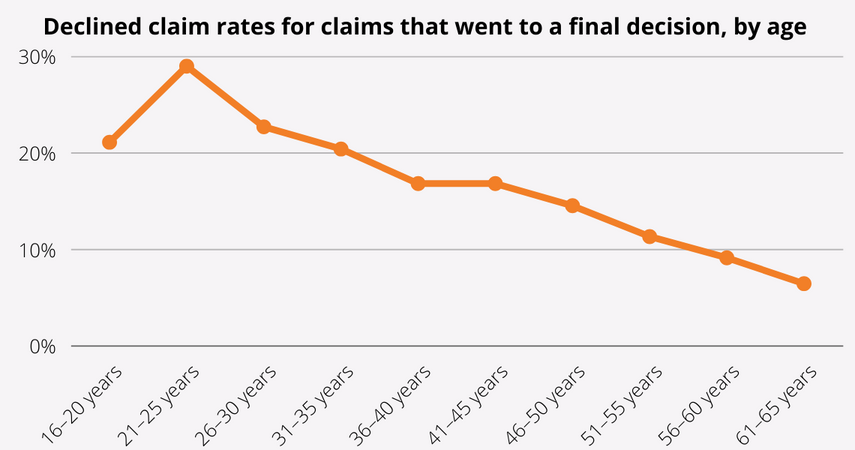

Is age an important factor for a TPD claim?

Is your age a factor for your TPD claim to get approved? The answer is not; however, there is a positive correlation between the age of the claimant and the approval rate of the claim. The highest refusal rate is amongst the claimants who are 21 – 25 years old, and this rate gradually decreases until the age of 65.

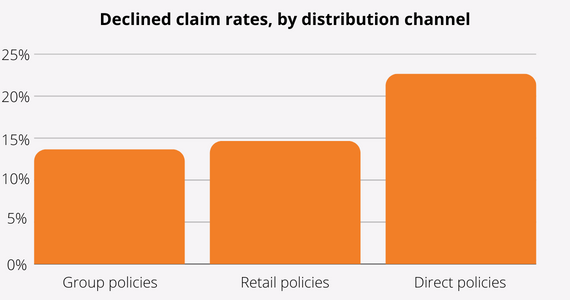

Which distribution channels get declined the most?

Group policies have the minimum decline rate (13.6%) amongst all policy types. Retail policies follow the group policies closely, and the direct policies’ refusal rate (22.6%) is dramatically higher than theirs.

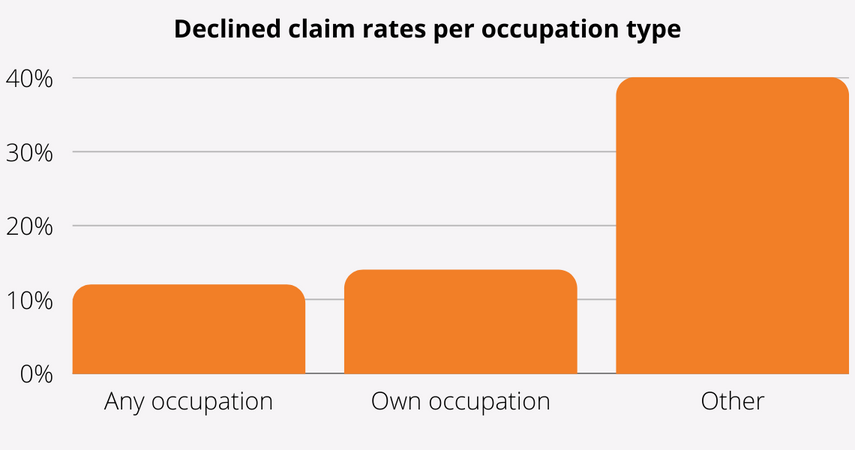

Does the occupation type change the success of the TPD claim?

The declined claim rate difference between any occupation and own occupation is not significant whereas the other occupation types have a 3 times higher refusal rate.

Do blue-collar workers have a higher chance to get their TPD claim accepted?

Occupation class is not a significant indicator when it comes to determining the success rate of the TPD claim however the statistics indicate that blue-collar workers’ TPD claim approval rate is higher than other occupation classes.

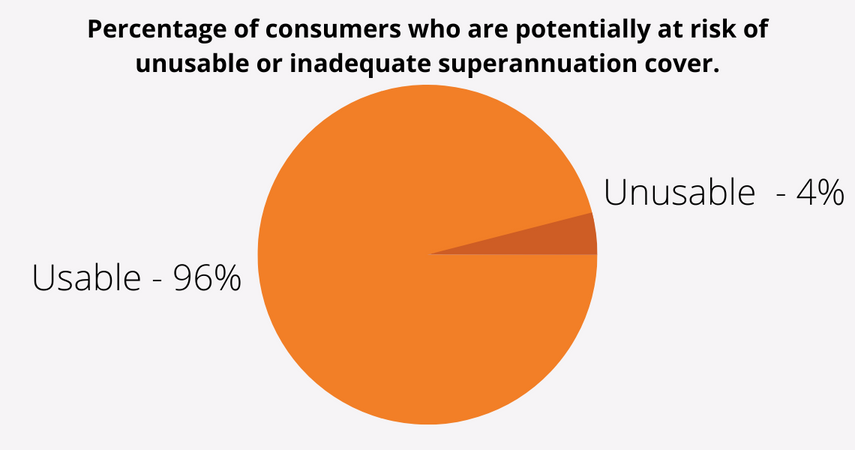

Am I eligible to make a TPD claim if I get injured?

96% of the superannuation policies are eligible for superannuation cover, and they generally include a lump sum payment if you suffer serious illness or injury and are unable to work. According to the statistics, only 4% of all consumers may not be eligible to receive TPD benefits.

What should I do if my TPD claim is declined?

As it’s mentioned above, there could be several reasons why your TPD claim is declined. Even though it is not your fault, your insurer can claim that you are not eligible or try to pay the minimum possible amount as a payout.

You should know that a declined claim does not mean that you will never get a TPD payout. If your TPD claim is declined, you can either submit a formal complaint to have your application reviewed again, or you can directly submit a complaint to the industry tribunal or financial ombudsman service. You can of course also commence court proceedings however there are adverse costs orders associated with that.

Making a TPD claim, even a refusal complaint can be complex. Our senior TPD lawyers have helped thousands of TPD claimants to receive their entitlements. You can contact our lawyers to review your refusal and provide advice on your prospects of success in challenging the decision.

How to make a successful TPD claim through super?

The safest and the most professional way of claiming TPD through super is working with an experienced TPD lawyer. You should remember that TPD is generally claimed only once in a lifetime and the amount that you may be entitled to cover your expenses financially especially whilst being unable to work.

TPD Insurance is usually claimed once which means it is probably your first time claiming TPD. The process is long, complex and tiresome even for those in good health. You may consider working with our TPD lawyers to ensure the success of your claim. Our TPD lawyers understand the process, and the evidence and information required to get your TPD claim approved in the shortest period of time. Contact us for your TPD insurance claim to receive the clearest, advice possible.

Finding a TPD lawyer

Finding a good TPD lawyer might not be as easy as you think. But if you are reading this page, you are close to contacting one. Our TPD claim lawyers who have offices conveniently located in NSW and WA can help you at any point in your TPD claim process.

Our TPD lawyers are willing to pay for your claim’s costs such as medical reports and other necessary documents to support your claim. Also, our No Win No Fee agreement prevents you from paying our legal costs unless you are successful and you receive payment.

Call us on 1800 952 901 or fill out the free claim check form below to start your TPD claim!

Free Initial Consultation

Step 1 of 3

- Select Claim TypeMotor Accident InjuryWork InjuryPublic InjuryMedical NegligenceSuperannuation/TPD

- Select StateNSWACTVICQLDSANTWATAS

- jQuery(document).ready(function($){ $('#gform_next_button_1_1').prop('disabled', true); $('#gform_1').find('#gform_page_1_1 :input').each(function(e){ formHasValue = false if (this.type === 'radio' || this.type === 'select-one') { $("#"+this.id).change(function() { disableValue = true if ($("select[name='input_5']").val() == '' || !$("input[name='input_6']:checked").val()) { disableValue = true } else { disableValue = false } $('#gform_next_button_1_1').prop('disabled', disableValue); }); } }); $('#gf_step_1_1').click(function(e) { $('#gform_page_1_1').show(); $('#gform_page_1_2').hide(); $('#gf_step_1_1').removeClass('gf_step_pending').addClass('gf_step_active'); $('#gf_step_1_2').addClass('gf_step_pending').removeClass('gf_step_active'); }); $('#gf_step_1_2').click(function(e) { $('#gform_page_1_2').show(); $('#gform_page_1_1').hide(); $('#gf_step_1_2').removeClass('gf_step_pending').addClass('gf_step_active'); $('#gf_step_1_1').addClass('gf_step_pending').removeClass('gf_step_active'); }); $('#gform_next_button_1_1').click(function(e) { var FormInput = $("select[name='input_5']").val(); var refused = $("input[name='input_6']:checked").val(); dataLayer.push({ event: 'assessment1', visatype: FormInput, refused: refused }); }); $('#gform_submit_button_1').click(function(e) { dataLayer.push({ event: 'assessment2' }); }); });

document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() );

Related blogs

Can I retire while on workers compensation?

What happens to my workers’ compensation when I retire? If you have been receiving weekly payments through your workers’ compensation claim and you have reached

Can Your Workers Compensation Claim Be Denied?

If you have been injured in the course of employment you are entitled to workers compensation entitlements which include but are not limited to wages,

Workers Compensation and Exempt Workers

Exempt workers are certain classes of workers who are not covered by the most of the provisions of the workers compensation acts in New South

Workers Compensation Weekly Benefits in NSW

Employers have a responsibility to fulfil their occupational health and safety obligations. This responsibility ensures that you receive entitlements if you are injured while working