Superannuation & TPD Lawyers Perth, WA

Total and Permanent Disability (TPD) insurance provides a way to claim superannuation benefits and a lump sum payment if you become unable to work due to total and permanent disability. At Withstand Lawyers, our experienced TPD lawyers in Perth specialize in helping clients navigate TPD insurance claims to secure the compensation they deserve.

Superannuation TPD benefits usually include:

You may be entitled to claim superannuation benefits regardless of where your injury occurred. Total and Permanent Disability (TPD) insurance typically ranges from $50,000 – $350,000, with income protection benefits covering up to 95% of your average wage paid in installments. Our experienced team of TPD lawyers in Perth will help you secure the maximum possible insurance benefits from your superannuation fund.

What payout can I expect from a TPD superannuation insurance claim?

The amounts you are entitled to depend on the type of insurance policy you have; this information is usually included in the fine print of your policy or statements.

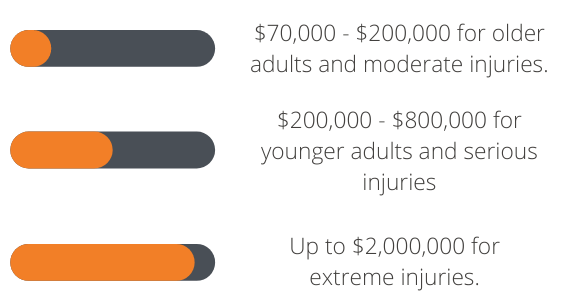

The TPD payments amounts typically range between:

- $70,000 and $200,000 for older adults;

- $200,000 and $800,000 for younger adults;

- Up to $2,000,000 in some cases.

Navigating superannuation policies and TPD benefits can be complex. It’s crucial to consult with an experienced superannuation lawyer who understands these intricacies. A knowledgeable lawyer can help determine your eligibility for TPD benefits and assist with making claims across multiple superfunds if necessary.

Am I eligible for a TPD claim?

How long does a superannuation claim take?

A decision on a superannuation claim is typically made within 3 months after all necessary documents are submitted. However, if the insurer lacks the required documents, the decision may be delayed. Conversely, if you are suffering from a terminal illness, the decision could be made sooner.

Please contact our TPD lawyers in Perth if you have lodged a superannuation claim and the decision hasn’t been made within 3 months, and we will investigate the reason behind the delay.

How much do TPD lawyers charge for superannuation claims in Perth?

At Withstand Lawyers you do not have to pay for out-of-pocket expenses, such as the medical reports required for your claim. In addition, we have a clear No Win No Fee Policy.

Our No Win No Fee policy for superannuation claims means you don’t pay us unless we secure a financial outcome for you. If you choose us to represent you, we will handle all the risks associated with your claim, as personal injury claims are our specialty.

Can I return to work after a Superannuation TPD payout?

To be eligible for a TPD claim, your health condition, illness, or injury must be the reason you can no longer work. Your claim should demonstrate that you are unable to work in any role related to your current education, training, or experience.

However, making a TPD claim does not necessarily prevent you from ever working again. In fact here are 3 possible scenarios we have seen with our clients:

You may start a job in a field you haven’t worked in before, which means you might not have known if you could do it. For example, you could have only been qualified and/or trained to be a carpenter but never worked in sales. Although you may never return to being a carpenter, you decide to try working in sales.

Your health condition, illness, or injury may significantly improve after treatment or a longer period than expected. For example, many clients who were battling cancer and believed they would never return to work have experienced remarkable recoveries and have gone back to their jobs. This positive outcome is incredibly rewarding for us and brings us great joy

Despite making a TPD claim, you might choose to pursue new qualifications or retrain in a field where you previously had no experience or qualifications. This decision allows you to continue moving forward and not give up on your career goals.

What to do if my TPD Superannuation claim is refused?

Insurance companies may occasionally make incorrect decisions. However, you have the right to request a review, file a complaint with the Australian Financial Complaints Authority (AFCA), or challenge the decision in court

If you find yourself in such where your TPD supperannuation claim is refused, please contact our senior TPD lawyers in Perth to understand your entitlements. As noted here, only 65% of TPD claims lodged were accepted by insurers.

What evidence do I need to provide with my TPD Superannuation claim?

To qualify for a Total and Permanent Disability (TPD) claim, you must have TPD cover and meet your insurance policy’s eligibility requirements. The most critical evidence required is medical documentation. TPD benefits are typically paid only if you are medically deemed unable to work in any occupation suited to your education, training, and experience. Without sufficient medical evidence to support your TPD claim, it is likely to be denied.

In addition to medical evidence, you should also provide your resume or other documentation of your education, training, and work experience. The insurer will assess both your medical evidence and your professional background to determine if you meet the policy’s definition of TPD.

Our TPD lawyers take pride in thoroughly reviewing your policy, which is often over 20 pages long. We ensure you fully understand what the policy means for you and whether you qualify to make a TPD claim. If we determine that you are eligible, we will handle the process of requesting and gathering all necessary evidence on your behalf.

Contact our No Win No Fee TPD Lawyers to get started on your claim.

According to an ASIC report out of the review it conducted, it found only 65% of TPD claims were accepted by insurers. Superannuation TPD claims are complex, and the legal process requires sufficient expertise in that area to receive what you are entitled to. Our superannuation lawyers have been helping people in Western Australia on a no win no fee basis; meaning that you only pay for our superannuation lawyers’ legal fees if you receive a lump sum payment.

Our experienced superannuation lawyers can assess the details of your superannuation policy without you being too worried about meeting the requirements and navigating through policies and definitions. Also, if you have an ongoing claim, our lawyers can assist you regarding how to move forward if your claim was rejected by your insurer or superfund.

Superannuation claims can be refused for many reasons. Some of the most common potential reasons are as follows:

- having an inactive or invalid policy

- failing to disclose pre-existing injuries.

- not meeting the disability that is outlined in your policy

- not having work history requirements

- not providing convincing medical evidence to support your superannuation claim

Your claim’s outcome depends on your insurer’s decision. Even though you think that you have provided all the evidence you can obtain, it might not be sufficient for the insurer. If you are frustrated due to that reason, you can reach one of our superannuation lawyers in Perth. We will help you understand and receive the highest possible superannuation benefits.

You have different options if your TPD claim is refused. Time limits are also dependent on whether you have complained to the insurer or not. If you have made a complaint to the insurer and they maintained their decision, you have 2 years to make a complaint to AFCA, otherwise, it’s a 6-year time limit to make a complaint to AFCA.

Yes, you can if you are a member of more than one superannuation fund at the time that you have suffered an injury or illness and stopped working, you will be able to claim a superannuation benefit from each superannuation fund.

The answer is no. You do not have to be in Perth to make a superannuation claim. Our superannuation lawyers are conveniently located throughout Western Australia. Our lawyers also offer home visits for our injured clients; feel free to call us on 1800 952 898 or fill out the free initial consultation form.

Why trust our superannuation lawyers in Perth?

TPD Insurance is usually claimed once in a lifetime; meaning that you haven’t gone through this process before. Legal procedures can be challenging for people who are inexperienced.

Our experienced superannuation TPD lawyers in Perth have assisted thousands of people, and we ensure the success of your superannuation claim, and we can:

- communicate with your insurer on your behalf;

- collate all the important facts and details;

- advise you on your eligibility prior to making a superannuation claim;

- ensure you receive the full superannuation benefits that you are entitled to;

- challenge the insurer’s decision if it denied your superannuation claim.

Contact our lawyers no matter how or where you were injured, or whether or not it was your fault. Our experienced team of TPD lawyers in Perth is ready to take on your claim today!

Issa Rabaya

• Bachelor of Laws

• Graduate Diploma in Legal Practice

• Approved Legal Service Provider to the Independent Review Office

• Member of the Law Society

Related blogs

Are You Getting What You Are Supposed to From Your TPD claim?

Before looking at what consumers are getting out of their TPD insurance and the effectiveness of their policies, it is important to define Total and

Total & Permanent Disablement (TPD) Superfund in Australia

What is TPD insurance in super? Superannuation, or just super, in short, refers to benefit funds for retirement. Employers are required to make payments to

When Should I Settle My Personal Injury Claim?

This is understandably one of the hardest decisions you would need to make in your personal injury claim. Regardless of whether it’s a car accident claim,